The Fed’s Interest Rate Outlook for 2025: Insider Knowledge

Anúncios

Understanding The Fed’s Interest Rate Outlook for 2025 is crucial as it directly impacts borrowing costs, investment returns, and overall economic stability, requiring a deep dive into monetary policy and market dynamics.

Anúncios

As we approach 2025, anticipating The Fed’s Interest Rate Outlook for 2025 becomes paramount for businesses, investors, and everyday consumers. The Federal Reserve’s decisions on interest rates ripple through every corner of the economy, influencing everything from mortgage rates to stock market performance. This comprehensive analysis will provide an insider’s perspective on the factors driving these critical monetary policy choices.

Understanding the Federal Reserve’s Mandate and Tools

The Federal Reserve, often simply called ‘The Fed,’ operates under a dual mandate from Congress: to foster maximum employment and stable prices. These two objectives often require a delicate balancing act, especially in dynamic economic environments. The tools at its disposal are powerful and varied, primarily focusing on influencing the cost and availability of money in the economy.

Anúncios

One of the Fed’s most prominent tools is the federal funds rate, which is the target rate for overnight lending between banks. By adjusting this rate, the Fed influences other interest rates throughout the economy, including those for consumer loans, mortgages, and business investments. A higher federal funds rate generally makes borrowing more expensive, which can cool down an overheating economy and curb inflation. Conversely, a lower rate stimulates borrowing and spending, encouraging economic growth and employment.

Key Monetary Policy Instruments

Beyond the federal funds rate, the Fed employs several other instruments to achieve its objectives. These tools allow for both broad and targeted interventions in financial markets.

- Open Market Operations (OMOs): The buying and selling of government securities in the open market. These operations directly affect the supply of reserves in the banking system, thereby influencing the federal funds rate.

- The Discount Rate: The interest rate at which commercial banks can borrow money directly from the Federal Reserve. While less frequently used for daily liquidity management, changes in the discount rate can signal the Fed’s stance on monetary policy.

- Reserve Requirements: The amount of funds that banks must hold in reserve against deposits. Altering these requirements can impact the amount of money banks have available to lend, though this tool is rarely adjusted due to its significant disruptive potential.

- Interest on Reserve Balances (IORB): The interest rate paid to commercial banks on the reserves they hold at the Fed. Adjusting the IORB helps steer the federal funds rate within its target range, acting as a floor for overnight lending rates.

Each of these tools can be deployed strategically to fine-tune economic conditions. The collective impact of these policies shapes the monetary landscape, directly influencing The Fed’s Interest Rate Outlook for 2025 and beyond. Understanding how these tools are wielded is fundamental to forecasting future rate movements.

Current Economic Landscape and Inflation Trends

The path to 2025 is significantly shaped by the current economic environment, particularly inflation and labor market dynamics. Recent years have seen unprecedented shifts, from supply chain disruptions to robust consumer demand, all contributing to inflationary pressures not seen in decades. The Fed’s primary challenge has been to bring inflation back down to its 2% target without triggering a severe economic downturn.

Analyzing the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index reveals the persistent nature of inflation. While headline inflation has shown signs of moderation, core inflation, which excludes volatile food and energy prices, has proven more stubborn. This stickiness complicates the Fed’s decision-making process, as it suggests underlying inflationary forces remain strong, possibly due to tight labor markets and wage growth.

Labor Market Resilience and Wage Growth

The labor market has demonstrated remarkable resilience, with unemployment rates remaining historically low. Strong job growth and rising wages are generally positive indicators, but they can also contribute to inflationary pressures. When wages increase, businesses may pass these higher labor costs on to consumers through higher prices, creating a wage-price spiral. The Fed closely monitors these trends to assess the overall health of the economy and potential inflationary risks.

Considering the current trajectory, the Fed’s decisions in 2025 will hinge on continued progress in disinflation and a gradual rebalancing of the labor market. Should inflation prove more persistent than anticipated, the Fed may be compelled to maintain a tighter monetary policy for longer, directly influencing The Fed’s Interest Rate Outlook for 2025 towards higher rates or fewer cuts than currently expected.

Global Economic Influences on Fed Policy

The U.S. economy does not operate in a vacuum; global economic conditions significantly influence the Federal Reserve’s policy decisions. International trade, geopolitical events, and the economic performance of major global partners can all impact domestic inflation, growth, and financial stability. These external factors add layers of complexity to the Fed’s forecasting models and strategy formulation.

For instance, slowdowns in major economies like China or the Eurozone can reduce global demand, potentially easing inflationary pressures in the U.S. Conversely, geopolitical conflicts or disruptions in global supply chains can exacerbate inflation by increasing commodity prices and hindering the flow of goods. The Fed must constantly assess these international developments to understand their potential spillover effects on the U.S. economy.

Currency Strength and Capital Flows

The strength of the U.S. dollar, often influenced by interest rate differentials between the U.S. and other countries, also plays a crucial role. A stronger dollar makes imports cheaper, which can help to curb inflation, but it also makes U.S. exports more expensive, potentially hurting domestic businesses. Capital flows, driven by investor sentiment and interest rate disparities, can impact financial market stability and the availability of credit within the U.S.

Therefore, when considering The Fed’s Interest Rate Outlook for 2025, it’s imperative to look beyond domestic borders. The interconnectedness of the global economy means that a holistic view, incorporating international economic data and geopolitical risks, is essential for accurate predictions of future monetary policy adjustments.

Market Expectations and Forward Guidance

Financial markets are constantly trying to anticipate the Federal Reserve’s next moves, with futures markets for the federal funds rate offering a real-time gauge of these expectations. These market-based probabilities are closely watched by analysts and policymakers alike, as significant divergences between market expectations and the Fed’s intended path can create volatility and uncertainty. The Fed, in turn, uses forward guidance to communicate its intentions and manage these expectations.

Forward guidance involves providing qualitative and quantitative information about the future path of monetary policy. This communication strategy aims to reduce uncertainty and enhance the effectiveness of policy by signaling how the Fed expects to react to evolving economic conditions. However, the effectiveness of forward guidance depends on its clarity and credibility, which can be challenging to maintain in rapidly changing economic circumstances.

The Role of Economic Projections

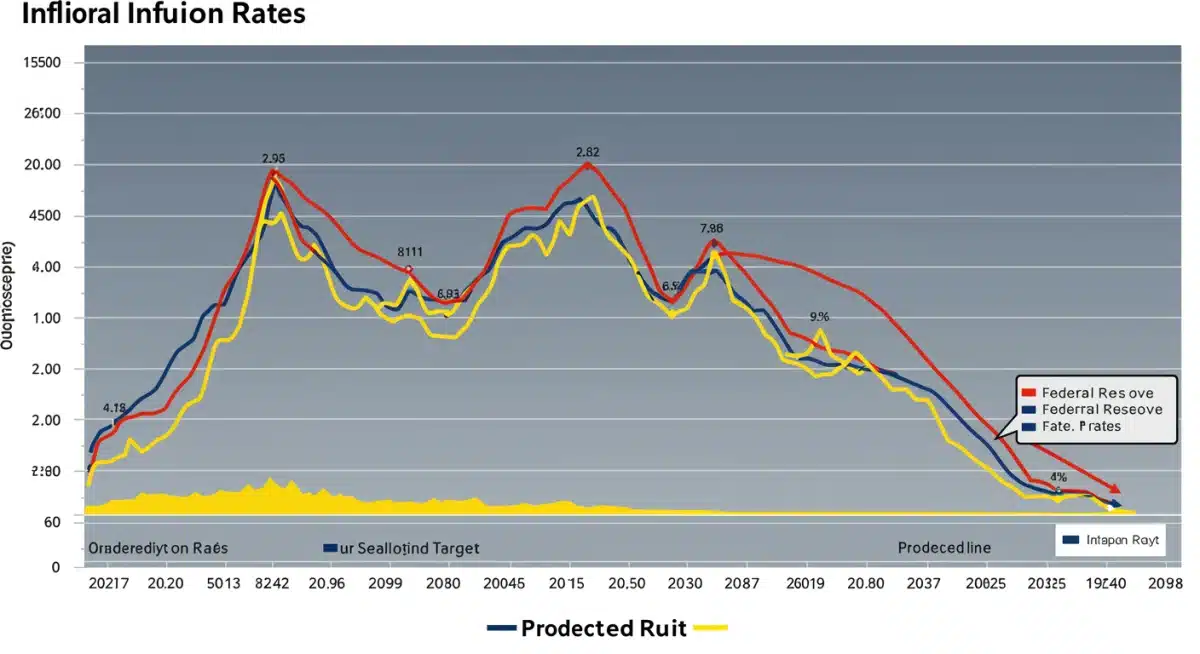

Every quarter, the Federal Open Market Committee (FOMC) releases its Summary of Economic Projections (SEP), which includes individual forecasts from FOMC participants for GDP growth, unemployment, inflation, and the federal funds rate. The ‘dot plot’ within the SEP, which graphs each participant’s projection for the federal funds rate, is particularly scrutinized. It provides a visual representation of how policymakers envision the future trajectory of interest rates.

While these projections are not commitments, they offer valuable insights into the collective thinking of the Fed. Analyzing these projections against market expectations helps us understand potential areas of consensus and disagreement, which are critical for discerning The Fed’s Interest Rate Outlook for 2025. A consistent message from the Fed, supported by economic data, builds confidence and helps anchor market expectations.

Potential Scenarios for 2025 Interest Rates

Forecasting interest rates is inherently complex, given the multitude of variables at play. However, by analyzing current trends and the Fed’s stated objectives, we can outline several plausible scenarios for The Fed’s Interest Rate Outlook for 2025. These scenarios are not mutually exclusive and could evolve based on incoming economic data.

One scenario involves a ‘soft landing,’ where inflation gradually returns to the 2% target without a significant economic downturn. In this case, the Fed might begin to gradually cut interest rates, perhaps by 25 to 50 basis points, to avoid overtightening and support sustained economic growth. This would be a welcome development for many, easing borrowing costs for consumers and businesses.

Alternative Economic Paths

Another scenario could see inflation proving more persistent, requiring the Fed to maintain current higher interest rates for a longer period, or even implement additional hikes. This ‘higher for longer’ approach would likely put more pressure on economic growth and potentially lead to a mild recession, as borrowing costs remain elevated. Such a path would be driven by factors like continued strong wage growth or new supply-side shocks.

- Aggressive Rate Cuts: If a significant economic downturn or recession materializes, coupled with rapidly falling inflation, the Fed could be compelled to implement more aggressive rate cuts to stimulate the economy. This would be a reactive measure to severe economic weakness.

- Stagnation with Inflation (Stagflation): A less desirable but possible scenario involves a combination of high inflation and slow economic growth. This would present a major challenge for the Fed, as traditional monetary tools are less effective in combating both simultaneously, potentially leading to prolonged uncertainty.

Each scenario carries distinct implications for financial markets, investment strategies, and household budgets. The Fed’s decisions will ultimately be data-dependent, adapting its strategy as economic conditions unfold throughout 2024 and into 2025. Monitoring these indicators closely will be key to navigating the economic landscape.

Impact on Various Sectors and Consumers

The Federal Reserve’s interest rate decisions have far-reaching consequences, impacting virtually every sector of the economy and the daily lives of consumers. Understanding these ripple effects is crucial for both strategic planning and personal financial management. The Fed’s Interest Rate Outlook for 2025 will directly influence borrowing costs, investment returns, and consumer spending patterns.

For consumers, changes in interest rates directly affect mortgage rates, auto loans, and credit card interest. Lower rates can make housing more affordable and reduce monthly payments, stimulating demand in the real estate sector. Higher rates, conversely, can cool down the housing market and increase the cost of consumer debt, potentially leading to reduced spending.

Business Investment and Corporate Borrowing

Businesses, particularly those reliant on financing for expansion and operations, are highly sensitive to interest rate fluctuations. Higher rates increase the cost of corporate borrowing, which can deter new investments, slow hiring, and reduce overall economic activity. Conversely, lower rates encourage companies to invest, innovate, and expand, contributing to job creation and economic growth.

- Stock Market Volatility: Interest rate changes can significantly impact stock market valuations. Higher rates tend to make bonds more attractive relative to stocks, potentially leading to outflows from equities. Lower rates often support higher stock prices by reducing the discount rate applied to future earnings.

- Sector-Specific Impacts: Industries such as technology and real estate, which are often highly sensitive to financing costs, can experience more pronounced effects from rate changes. Financial institutions, on the other hand, might see their profitability affected by changes in net interest margins.

- Savings and Retirement: For savers, higher interest rates mean better returns on savings accounts and fixed-income investments, while lower rates can make it challenging to generate income from conservative investments.

Therefore, tracking The Fed’s Interest Rate Outlook for 2025 is not just an academic exercise; it’s a practical necessity for making informed financial decisions across all facets of the economy. The implications extend from individual household budgets to the strategic planning of multinational corporations.

| Key Aspect | Brief Description |

|---|---|

| Inflation Target | Fed aims for 2% PCE inflation, influencing rate decisions. |

| Labor Market | Strong employment and wage growth impact inflationary pressures. |

| Global Economy | International trade and geopolitics influence domestic policy. |

| Market Expectations | Forward guidance and dot plot shape investor sentiment and forecasts. |

Frequently Asked Questions About Fed’s 2025 Outlook

The Federal Reserve operates under a dual mandate from Congress: to achieve maximum employment and maintain stable prices. This involves balancing economic growth with controlling inflation, using various tools to influence the money supply and interest rates.

High inflation typically prompts the Fed to raise interest rates to cool down the economy and reduce price pressures. Conversely, low inflation or deflation might lead to rate cuts to stimulate spending and investment, aiming for its 2% target.

The ‘dot plot’ is part of the Fed’s Summary of Economic Projections, showing individual FOMC members’ forecasts for the federal funds rate. It’s crucial as it offers insight into the collective thinking of policymakers regarding future interest rate trajectories.

Global economic slowdowns can ease U.S. inflation by reducing demand, while geopolitical events or supply chain disruptions can exacerbate it. The Fed considers these external factors to assess their impact on domestic conditions and policy.

A ‘higher for longer’ scenario implies the Fed maintains elevated interest rates for an extended period. This could lead to increased borrowing costs for consumers and businesses, potentially slowing economic growth and potentially triggering a mild recession.

Conclusion

The Federal Reserve’s interest rate outlook for 2025 remains a complex and evolving picture, shaped by a confluence of domestic economic data, global developments, and the Fed’s dual mandate. While the precise path of interest rates is subject to change, understanding the underlying drivers—inflation trends, labor market dynamics, international influences, and the Fed’s communication strategies—provides a critical framework for anticipating future policy moves. For individuals and institutions alike, staying informed about these intricate economic forces will be essential for making sound financial decisions and navigating the economic landscape of the coming year.