Supply Chain Adjustments & U.S. Consumer Prices in 2025

Anúncios

Global supply chain adjustments in 2025 will significantly influence U.S. consumer prices, driven by evolving geopolitical landscapes, technological advancements, and a push towards regionalized production, leading to varied financial impacts on households.

Anúncios

The impact of global supply chain adjustments on U.S. consumer prices in 2025 – financial impact is a topic gaining increasing traction among economists, policymakers, and everyday Americans. As the world continues to grapple with the aftermath of recent disruptions, a clearer picture of how these changes will reshape the economic landscape, particularly for consumers, is beginning to emerge. Understanding these intricate dynamics is crucial for navigating the evolving financial realities of the coming year.

Anúncios

understanding the current global supply chain landscape

The global supply chain, a complex network of interconnected systems, has undergone unprecedented stress and transformation in recent years. From pandemic-induced shutdowns to geopolitical tensions and environmental exigencies, the delicate balance that once characterized international trade has been irrevocably altered. These shifts are not merely temporary blips; they represent a fundamental recalibration of how goods are produced, transported, and consumed worldwide, with direct consequences for the American consumer.

Before delving into the specifics of 2025, it’s essential to recognize the foundational changes that have already occurred. Companies have been forced to re-evaluate their reliance on single-source suppliers and just-in-time inventory models. This re-evaluation is paving the way for more resilient, albeit potentially more expensive, supply chain strategies. The push for diversification and redundancy, while offering long-term stability, often comes with initial cost increases that eventually trickle down to the consumer.

key drivers of change

- Geopolitical Tensions: Trade disputes, sanctions, and regional conflicts continue to fragment global markets, compelling businesses to seek alternative sourcing and manufacturing locations.

- Technological Advancements: Automation, AI, and advanced analytics are being integrated to optimize logistics, predict disruptions, and enhance supply chain visibility, though implementation costs can be substantial.

- Sustainability Initiatives: Increasing pressure for environmentally friendly practices is leading to shifts in transportation methods and material sourcing, often with higher associated expenses.

- Labor Market Dynamics: Wage inflation and labor shortages in key manufacturing and logistics sectors impact production costs and delivery times.

These drivers collectively contribute to an environment where predictability is scarce, and adaptability is paramount. The immediate effect on consumer prices is often an upward trend, as businesses factor in increased operational costs, insurance premiums, and the investment required for futureproofing their supply networks. This initial phase of adjustment is critical to understanding the impending financial impact on U.S. households.

In conclusion, the current global supply chain landscape is defined by its volatility and the strategic responses of businesses to mitigate risk. These foundational changes, driven by a confluence of geopolitical, technological, and environmental factors, are setting the stage for significant shifts in consumer prices in the U.S. as we approach 2025, necessitating a closer examination of their direct financial implications.

reshoring and nearshoring trends: cost implications

One of the most significant adjustments in global supply chains is the accelerating trend of reshoring and nearshoring. This involves companies moving production facilities closer to their primary markets, often back to the United States or neighboring countries like Mexico and Canada. While this strategy aims to reduce transit times, enhance quality control, and improve supply stability, it carries distinct cost implications that will directly influence U.S. consumer prices in 2025.

The primary financial challenge of reshoring lies in the higher labor costs and regulatory compliance in the U.S. compared to traditional offshore manufacturing hubs. While automation can offset some of these expenses, the initial investment in new facilities, machinery, and employee training is substantial. These capital expenditures, coupled with ongoing operational costs, are typically passed on to consumers in the form of higher retail prices for domestically produced goods.

advantages and disadvantages for consumers

While the immediate impact might be higher prices, there are also long-term benefits for consumers. Reduced lead times mean products are less likely to be out of stock, and improved quality control can lead to more durable goods. Furthermore, a more localized supply chain is less vulnerable to international shipping delays or geopolitical disruptions, offering greater stability in product availability.

- Higher Production Costs: Increased wages, regulatory compliance, and initial investment in new facilities contribute to higher manufacturing expenses.

- Reduced Shipping Costs and Times: Proximity to market can cut down on international freight expenses and delivery schedules.

- Enhanced Quality Control: Closer oversight of production can lead to higher quality products and fewer defects.

- Increased Supply Chain Resilience: Less susceptibility to global disruptions ensures more consistent product availability.

Nearshoring, on the other hand, offers a middle ground, leveraging lower labor costs in neighboring regions while still benefiting from geographical proximity. This approach may present a more balanced cost-benefit analysis for businesses, potentially leading to slightly less dramatic price increases for consumers compared to full reshoring. However, it still involves adjusting existing logistical networks and investing in new regional partnerships.

Ultimately, the move towards reshoring and nearshoring represents a strategic shift from cost minimization to risk mitigation. While this might result in a slight uptick in the price tags of certain goods, it also promises greater reliability and availability. Consumers in 2025 will increasingly encounter products with a “Made in USA” or “Made in North America” label, potentially at a premium, as businesses prioritize supply chain security over rock-bottom production costs.

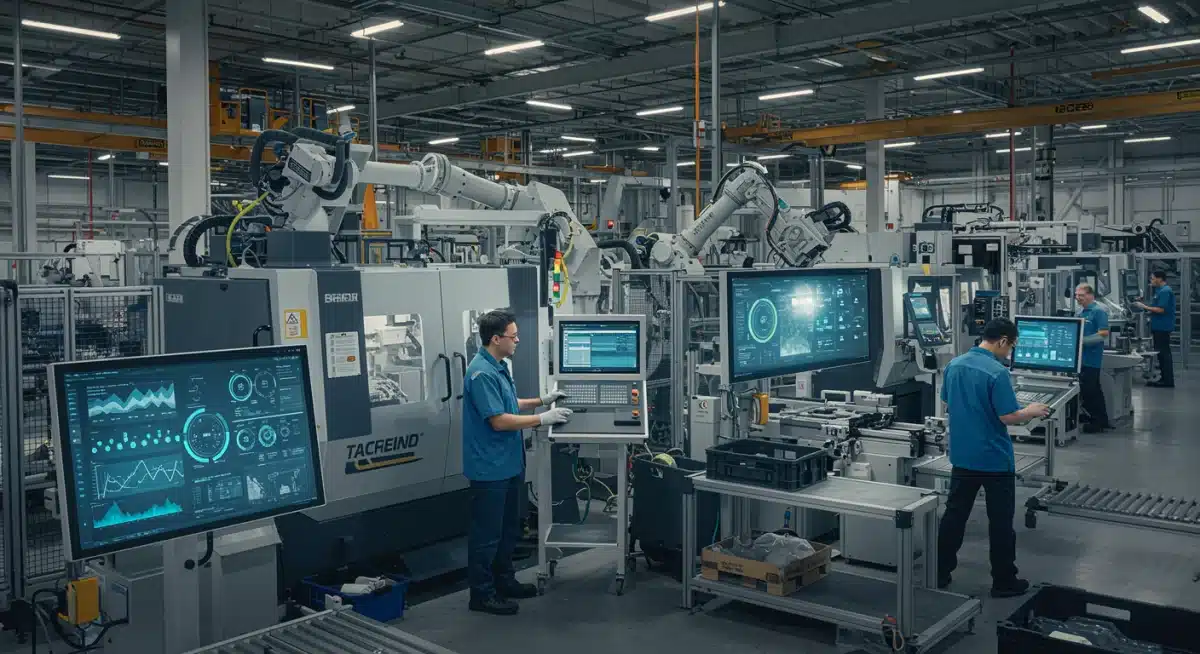

technological integration and automation: efficiency vs. cost

The drive towards greater efficiency and resilience in supply chains is heavily reliant on technological integration and automation. From advanced robotics in warehouses to AI-powered predictive analytics for demand forecasting, technology is reshaping every facet of logistics and manufacturing. While these innovations promise long-term benefits, their initial implementation and ongoing maintenance costs will undeniably play a role in shaping U.S. consumer prices in 2025.

Automation, particularly in manufacturing and warehousing, can significantly reduce labor costs and increase production speed and accuracy. Robots can work 24/7, performing repetitive tasks with precision, thereby boosting output. However, the upfront investment in robotic systems, software, and the specialized personnel required to manage them is substantial. Companies must amortize these costs over time, and a portion is often reflected in the final price of goods.

the dual impact of digital transformation

Digital transformation extends beyond physical automation to encompass sophisticated data analytics and cloud-based platforms. These tools enable businesses to gain unprecedented visibility into their supply chains, identify bottlenecks, and optimize routes. This enhanced efficiency can lead to reduced waste, lower transportation costs, and more agile responses to market changes, theoretically leading to cost savings that could benefit consumers.

- Upfront Investment: High capital expenditure for robotics, AI software, and digital infrastructure.

- Operational Savings: Reduced labor costs, optimized logistics, and minimized waste through predictive analytics.

- Improved Responsiveness: Faster adaptation to demand shifts and disruptions, leading to more consistent product availability.

- Data Security Costs: Increased investment in cybersecurity to protect sensitive supply chain data.

In 2025, consumers will likely see a mixed impact. Products from highly automated and technologically integrated supply chains might carry a premium due to the initial investment, but they may also offer greater reliability and potentially innovative features. The long-term trajectory suggests that as technology becomes more ubiquitous and affordable, its cost-saving benefits will increasingly be passed on, but the near term involves a delicate balance between investment and pricing strategies.

energy and transportation costs: a persistent inflationary pressure

Energy and transportation costs remain critical components in the overall pricing structure of goods, and their volatility poses a persistent inflationary pressure on U.S. consumer prices. In 2025, global energy markets are expected to continue their dynamic trajectory, influenced by geopolitical events, production levels, and the ongoing transition to renewable sources. These fluctuations directly impact the cost of moving goods across continents and within domestic networks.

Fuel is a significant operating expense for shipping, trucking, and air freight companies. Any sustained increase in oil and gas prices inevitably leads to higher freight rates, which are then incorporated into the final price consumers pay for everything from electronics to groceries. Even with advancements in fuel efficiency and the adoption of electric vehicles in logistics, the sheer scale of global trade means fossil fuels will remain a dominant factor in the near future.

factors influencing energy and transport costs

Beyond fuel, other elements contribute to transportation expenses. Labor costs for drivers, pilots, and port workers continue to rise. Infrastructure investments, such as upgrading ports, railways, and highways, although beneficial in the long run, can also translate into higher fees or taxes for logistics providers, which are then passed on. Furthermore, increasing regulatory requirements for emissions and safety add another layer of cost to the transportation sector.

- Global Oil Prices: Volatility due to geopolitical events, OPEC+ decisions, and demand-supply imbalances.

- Labor Wages: Rising salaries for transportation and logistics personnel.

- Infrastructure Investments: Costs associated with upgrading and maintaining transportation networks.

- Environmental Regulations: Compliance costs for reducing emissions and adopting sustainable practices.

The shift towards more regionalized supply chains, while reducing international shipping, doesn’t entirely eliminate the impact of energy costs. Domestic transportation still relies heavily on fuel, and any increases here will still affect goods produced closer to home. Moreover, the demand for more expedited shipping options, often at a higher cost, continues to grow, further adding to the overall price structure.

In summary, consumers in 2025 should anticipate that energy and transportation costs will continue to exert upward pressure on prices. Businesses will endeavor to absorb some of these costs through efficiency gains, but a significant portion will likely be reflected in retail prices, making it a critical area to monitor for inflationary trends.

consumer demand and purchasing power: balancing act

The interplay between consumer demand and purchasing power forms a critical balancing act that will significantly influence how global supply chain adjustments translate into actual U.S. consumer prices in 2025. While supply-side factors drive potential price increases, the willingness and ability of consumers to pay those prices ultimately determine market equilibrium. A robust economy with strong employment and wage growth can absorb higher prices more effectively than one facing economic headwinds.

In 2025, U.S. consumer demand is expected to remain relatively strong, although potentially moderated by higher interest rates and persistent inflation. Savings accumulated during the pandemic have largely dwindled, and consumers are increasingly relying on current income and credit. This means that significant price increases, especially for discretionary goods, could lead to a noticeable drop in demand, forcing businesses to re-evaluate their pricing strategies or absorb more costs themselves.

factors influencing consumer behavior

Purchasing power, the real value of money in terms of the goods and services it can buy, is key. If wage growth outpaces or keeps pace with inflation, consumers can maintain their living standards despite rising prices. However, if inflation consistently exceeds wage increases, purchasing power erodes, leading to a more cautious spending environment. This delicate balance dictates how much pricing flexibility businesses truly have when faced with increased supply chain costs.

- Wage Growth: The pace of salary increases relative to inflation determines real purchasing power.

- Interest Rates: Higher rates impact borrowing costs for consumers, affecting purchases of big-ticket items and overall credit usage.

- Consumer Confidence: Optimism about the economic future encourages spending; pessimism leads to saving.

- Savings Rates: The availability of disposable income or accumulated savings influences willingness to pay higher prices.

Businesses will likely employ various strategies to manage this balancing act. This could include offering more value-oriented products, adjusting product sizes, or implementing dynamic pricing models. The competitive landscape will also play a role; in highly competitive sectors, companies might be more reluctant to pass on full cost increases to avoid losing market share, opting instead to compress their margins.

Therefore, while global supply chain adjustments will undoubtedly create upward pressure on prices, the final impact on U.S. consumer prices in 2025 will be heavily mediated by the state of consumer demand and purchasing power. A resilient consumer base can cushion the shock, but a weakening one could exacerbate it, leading to complex market dynamics.

government policies and trade agreements: shaping the economic future

Government policies and international trade agreements play a pivotal role in shaping the economic environment in which global supply chain adjustments occur, thereby influencing U.S. consumer prices in 2025. Tariffs, subsidies, regulatory frameworks, and multilateral trade pacts can either exacerbate or mitigate the financial impact of supply chain disruptions, directly affecting the cost of imported and domestically produced goods.

For instance, current trade policies, particularly those aimed at reducing reliance on specific countries or encouraging domestic production, can introduce new costs. Tariffs on imported goods make them more expensive for U.S. consumers, while subsidies for domestic industries, though intended to foster growth, are ultimately funded by taxpayers and can indirectly contribute to inflation if not managed carefully. The balance between protecting national interests and maintaining competitive pricing is a constant challenge for policymakers.

impact of trade and domestic policies

New trade agreements or renegotiations of existing ones could also significantly alter supply chain routes and costs. Agreements that streamline customs processes, reduce non-tariff barriers, or foster greater regional integration can lower logistical expenses. Conversely, more protectionist policies could fragment global trade further, leading to higher prices as companies navigate more complex and costly international transactions.

- Tariffs and Import Duties: Directly increase the cost of imported goods for consumers.

- Domestic Subsidies: Can support local production but are funded by taxpayers and may not always lead to lower consumer prices.

- Regulatory Frameworks: Environmental, labor, and safety regulations can add compliance costs to businesses.

- International Trade Agreements: Can reduce barriers and streamline trade, potentially lowering costs, or increase them through protectionist measures.

Furthermore, domestic policies aimed at infrastructure development, workforce training, or energy transition also have long-term implications for supply chain efficiency and cost. Investments in modernizing ports, roads, and digital networks can reduce bottlenecks and improve delivery times, potentially offsetting some inflationary pressures. However, these investments often take time to yield full benefits and may involve initial public spending.

In 2025, U.S. consumers will experience the cumulative effect of these governmental decisions. A policy landscape that prioritizes supply chain resilience and efficiency while carefully managing trade relations could help stabilize or even reduce certain consumer prices. Conversely, policies that create new barriers or significantly increase business operating costs without corresponding efficiency gains will likely contribute to higher prices across various sectors.

strategies for businesses and consumers to adapt

As global supply chain adjustments continue to influence U.S. consumer prices in 2025, both businesses and consumers must adopt proactive strategies to adapt to the evolving financial landscape. The ability to anticipate changes and implement effective measures will be crucial for mitigating negative impacts and capitalizing on new opportunities. This adaptability is key to navigating the complexities of modern economic trends.

For businesses, a multi-pronged approach is essential. Diversifying supplier networks, investing in advanced analytics for better forecasting, and exploring automation are no longer optional but critical for survival. Companies should also focus on building stronger relationships with their logistics partners and considering regional distribution hubs to reduce dependence on single, long-distance supply routes. Transparency with consumers about pricing changes and supply chain challenges can also build trust and manage expectations.

consumer coping mechanisms

Consumers, too, have options to navigate potential price increases. Budgeting and financial planning become even more important, allowing households to prioritize essential spending and identify areas where cuts can be made. Seeking out deals, utilizing loyalty programs, and considering generic or store-brand alternatives can help offset some of the rising costs for everyday goods. Moreover, supporting local businesses and products, while potentially more expensive, can sometimes offer more stable pricing and product availability due to shorter supply chains.

- For Businesses:

- Diversify suppliers and manufacturing locations.

- Invest in supply chain technology and automation.

- Strengthen logistics partnerships and explore regional hubs.

- Enhance inventory management and forecasting capabilities.

- For Consumers:

- Practice diligent budgeting and financial planning.

- Seek out sales, discounts, and loyalty programs.

- Consider generic or store-brand alternatives.

- Prioritize essential spending and reduce discretionary purchases.

Another important strategy for consumers is to stay informed about economic trends and potential price shifts. Understanding which sectors are most affected by supply chain issues can help in making informed purchasing decisions. For instance, if certain imported goods are expected to become more expensive, consumers might choose to buy domestically produced alternatives or make purchases before anticipated price hikes.

Ultimately, adaptation for both businesses and consumers involves a shift in mindset from expecting predictable, low-cost goods to valuing resilience, reliability, and informed decision-making. By embracing these strategies, the financial impact of global supply chain adjustments in 2025 can be managed more effectively, fostering greater stability in an uncertain economic environment.

| Key Impact Area | Brief Description of Financial Impact |

|---|---|

| Reshoring Costs | Higher labor and production costs in the U.S. leading to increased retail prices for some goods. |

| Energy & Transport | Volatile fuel prices and rising logistics expenses contributing to overall inflationary pressures. |

| Technology Investment | Initial capital expenditure for automation passed on to consumers, potentially offset by long-term efficiencies. |

| Government Policy | Tariffs and domestic subsidies influencing import costs and overall market competitiveness. |

frequently asked questions about supply chain and consumer prices

Food prices in 2025 will be influenced by global supply chain adjustments through increased transportation costs for imported produce, higher energy costs for processing and refrigeration, and potential shifts in agricultural trade policies. Localized sourcing could stabilize some prices, but overall, slight increases are anticipated due to these upstream factors.

Initially, reshoring efforts may not lead to lower prices for U.S.-made products due to higher domestic labor and operational costs. However, in the long term, reduced shipping expenses, enhanced quality, and greater supply stability could offer better value, even if the sticker price remains slightly higher than previously imported goods.

Automation can mitigate supply chain cost increases by reducing labor dependency, enhancing efficiency, and improving accuracy in manufacturing and logistics. While initial investment is high, automated systems can lead to long-term operational savings, quicker response times, and less waste, potentially stabilizing prices or slowing their rise over time.

U.S. consumers can prepare for potential price changes by focusing on prudent budgeting, increasing savings, and seeking out value-oriented products. Diversifying shopping habits, comparing prices, and considering local alternatives can also help manage household expenses amidst evolving global supply chain dynamics and their impact on consumer goods.

Government trade policies have the potential to both stabilize and destabilize prices. Policies promoting free trade and efficient logistics can lower costs, while protectionist measures like tariffs can increase them. The net effect in 2025 will depend on the specific balance and implementation of these policies, aiming to balance national interests with consumer affordability.

conclusion

The impact of global supply chain adjustments on U.S. consumer prices in 2025 – financial impact is poised to be a defining economic narrative. The convergence of reshoring efforts, technological integration, volatile energy costs, and evolving government policies creates a complex tapestry of inflationary pressures and potential efficiencies. While consumers may face higher prices for certain goods due to increased production and transportation expenses, these shifts are also driving greater supply chain resilience and reliability. Both businesses and households will need to remain agile and strategically adapt to these changes, embracing informed decision-making to navigate the financial implications effectively. The journey towards a more robust, albeit potentially more expensive, global supply network is underway, and its effects will be felt in every American household.